Colliers International is a leading global real estate services and investment management company. With operations in 68 countries, they work collaboratively to provide expert advice and services to maximize the value of property for real estate occupiers, owners and investors. AccuCities 3D London model has been used by Colliers International on a number of Planning and Rights of Light projects.

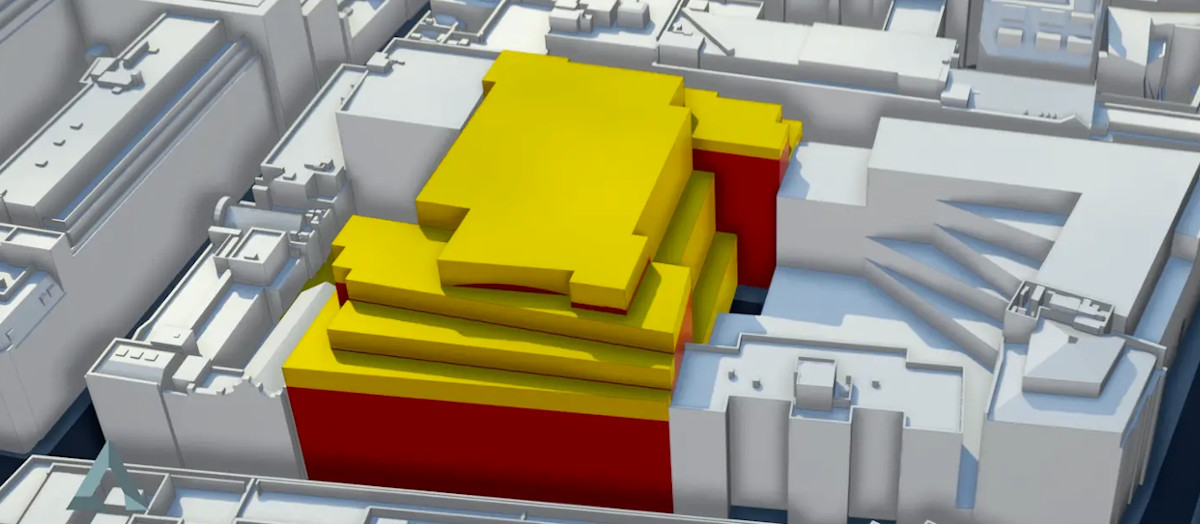

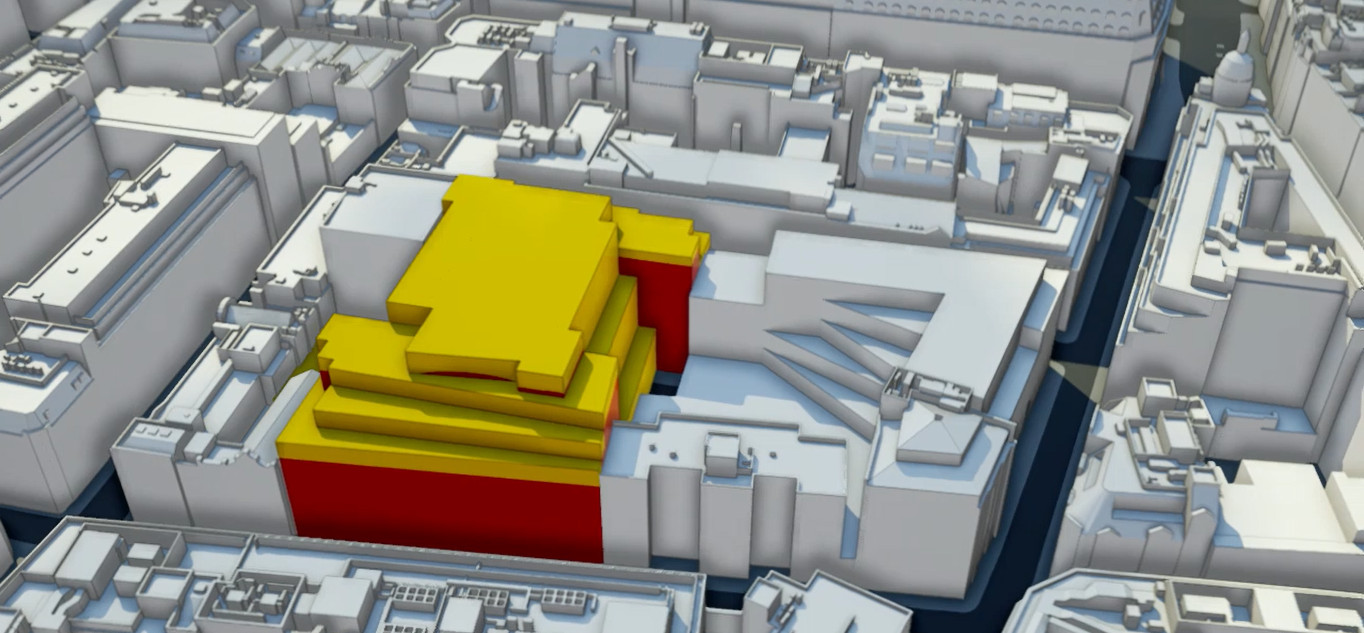

Cathryn Buckland, Associate Director in the Rights of Light department, said: “In our line of work 3D city models are used as part of our standard operation. AccuCities models are ideal for a collaborative organisation like ours as they come in a variety of formats and with a company-wide licence. That allows us to get as many hands on deck as needed and almost everyone can use the same 3D data. We can conduct fast streamlined preliminary site evaluations from multiple perspectives and then, like in this example, communicate the development potential to our clients and investors.”

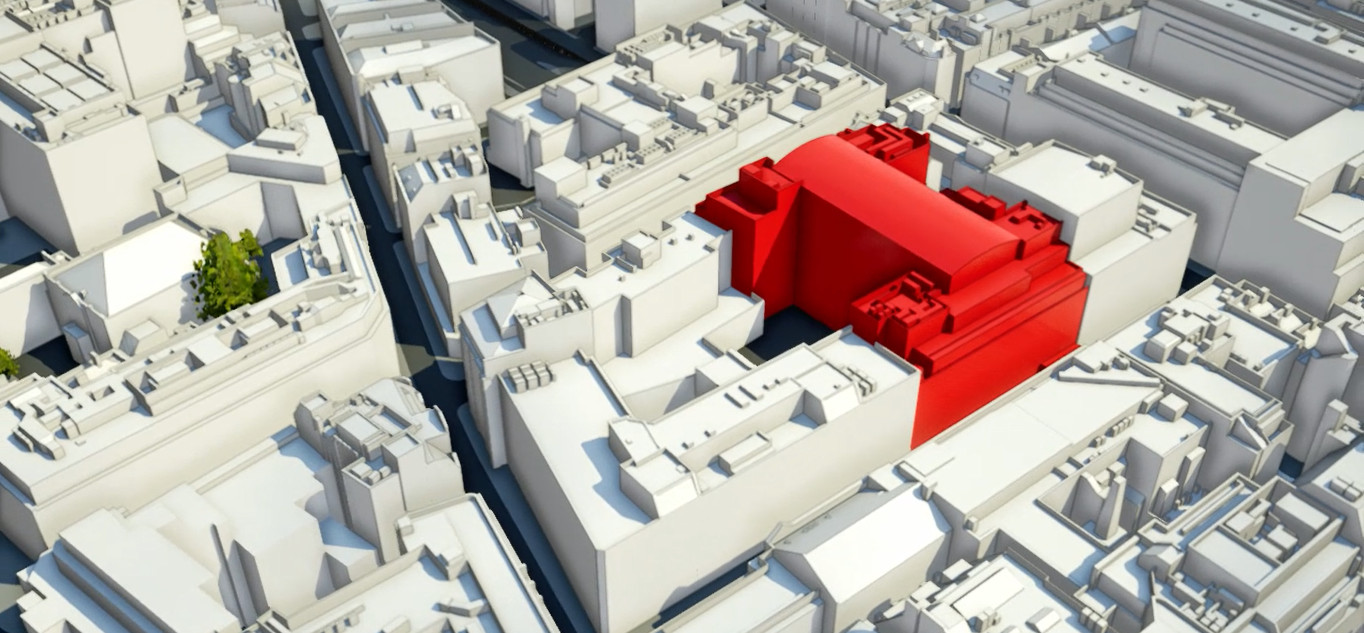

“Marketing is one area where tech could play a greater role in commercial property investment.” says Andrew Mercer, Office Sector Lead at Legal & General Investment Management. “We have worked with Colliers to build a website for the Bonhill Building in London’s fashionable Shoreditch that features a virtual London flyover with an animation indicating future development potential.”

“Agents have used password-protected intranet sites for some time but providing an open-access marketing website is still new for the investment market.” continues Mercer. “This gives overseas investors real-time access to new properties and building data. And while virtual animation hosted on a marketing website is hardly revolutionary, it shows that tech could lead to structural changes in investment agency and due diligence. In the future, we expect virtual reality to bring building health indicators to life, enabled by building information modelling and sensors showing wellbeing and environmental conditions, leading to a ‘full-service history’ becoming available, which could influence pricing and liquidity.”